Australian PBS Supply Chain

The supply chain for Australian Pharmaceutical Benefits Scheme (PBS) medicines has come sharply into focus during the changes to rebate arrangements recently pursued by the Federal Government, and whose introduction has subsequently been delayed until July 2019.

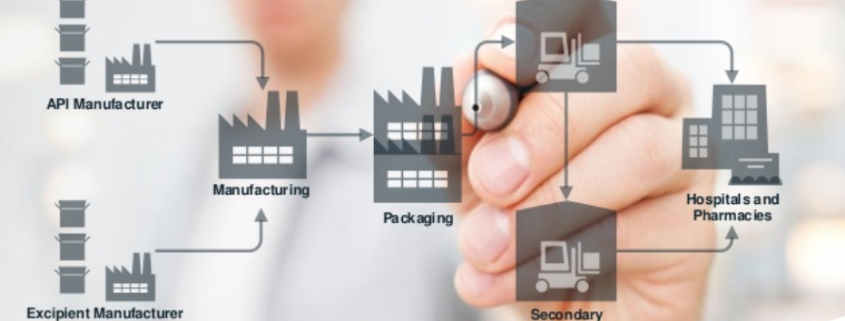

Supply chain refers to the specialised pharmaceutical wholesalers and pharmacies (community and hospital) that provide distribution, dispensing and patient care services associated with each listed medicine beyond the manufacturer’s door. This is not necessarily a straight forward endeavour in a sparely populated large country like Australia, and considering the cold-chain and other storage and handling requirements for some medicines.

While the PBS debate has been about time to and funding of new listings, as well as overall investment in the scheme, protagonists of the supply chain have been efficiently taking steps to secure, and even grow their proportion of the PBS ‘pie’. Current estimates put supply chain costs, after removal of rebates, as representing up to as much as 40% of Government expenditure on the PBS.

To put this in context, the proportion is comparable to the 41% reported for the sector in the USA, although the supply chain there includes the additional players in Pharmacy Benefit Managers and Insurers to be compensated.

The details of Government payments for provision of universal access to PBS medicines for Australians, no matter where they live within 24-hours, are contained in a series of, usually 5-year, agreements between supplier associations and the Commonwealth Government.

The content of some these agreements will be reviewed in the next few articles.